Marvelous Tips About How To Avoid Paying Credit Cards

Contact your credit card issuer and ask them to waive your cash advance fee.

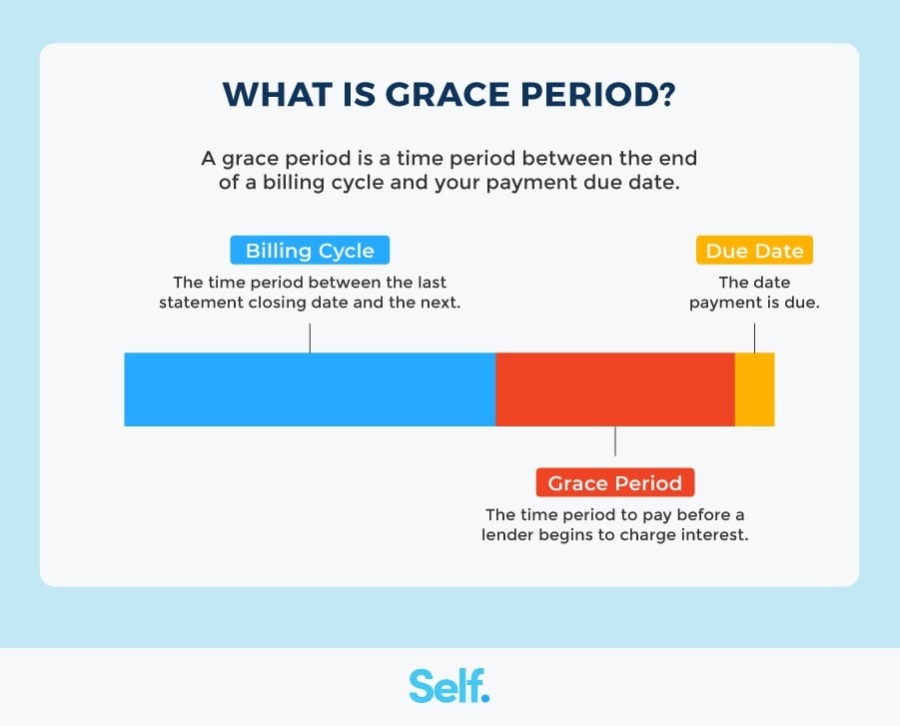

How to avoid paying credit cards. Generally, you can avoid credit card interest by paying your balance in full every month before the end of the grace period. Most credit cards have variable interest rates, which means that the rate changes based on your credit history. If you’re on a hunt to learn how to avoid credit card interest, one of the easiest ways to do this is by paying off the credit card balance in full, each month.

How to avoid this fee: They might be willing to do this once, but probably not as a regular thing. If you’re not sure what your rate is, ask your credit card company.

We can never stress enough how important paying your bills on time each month is. Paying your entire balance each month is the best way to avoid credit card debt. Sometimes, when a bank launches a new credit card in the market, they give free annual fee for life to a certain number of people that will avail of the cards during their.

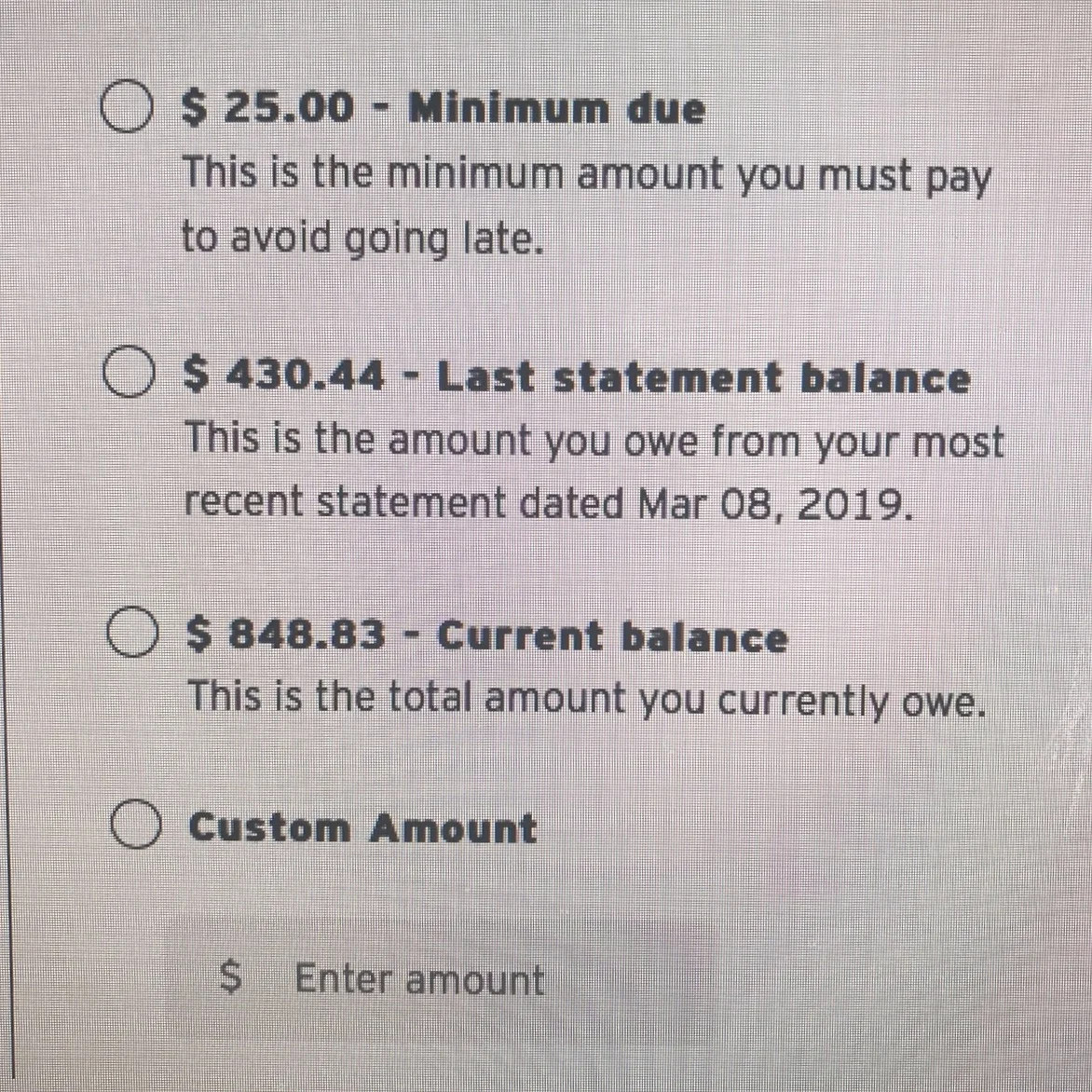

1.2 treat your credit card like a debit card. Pay as much as possible to lower the balance and to avoid paying more in interest. The bottom line is, just because you may be able to pay a loan with a credit card, it doesn’t mean you should.

Make your monthly payments on time. One of the most basic ways to avoid paying credit card interest is not to use credit cards at all, and instead use debit cards. If you’re unable to pay your credit card balance in full each month,.

Prioritizing your payments can help you avoid credit card debt. To do this, pay the minimum balance on all of your cards except for the one with the. Fico credit scores are one of the most common credit scoring models used.